Insights

EU ETS success depends on preparation and partnership

The European Union’s Emissions Trading System is here and is changing the way owners and operators approach and manage their fuel strategies. Jesper Sørensen, Head...

Pacific International Lines First Shipping Line To Complete Full Integration With SGTraDex In Collaboration With KPI OceanConnect

29 January 2024: Pacific International Lines (PIL) has successfully completed full integration with the Singapore Trade Data Exchange (SGTraDex) platform, making PIL the first shipping...

KPI OceanConnect Delivers Biofuel Bunkering First for Fujairah

KPI OceanConnect, a leading global provider of marine energy solutions, today announced it has supplied 200mt of B24 VLSFO to the bulk carrier GCL Tapi...

KPI OceanConnect, Titan Clean Fuels, and SFL Collaborate on Milestone LNG Bunkering Operation

KPI OceanConnect, has collaborated with Titan Clean Fuels, and SFL to successfully complete the company’s first LNG bunkering operation for the newly built car carrier,...

KPI OceanConnect supplies OOCL with biofuel blend marking a significant milestone in their sustainability journeys

KPI OceanConnect, a leading global marine energy solutions provider, today announced the successful sale and supply of a B24 biofuel blend to Orient Overseas Container Line...

AuctionConnect leads the way towards a greener future for shipping with the addition of biofuels to the platform

Shipping faces a range of strict regulations that will drive it towards decarbonisation. For investors and shipowners alternative fuels are an important pillar of compliance....

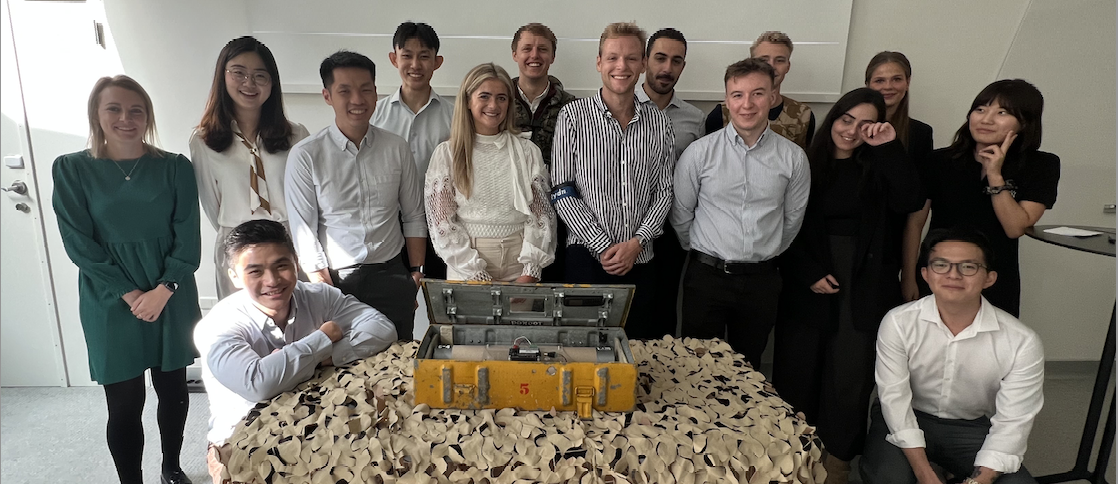

“get fuelled”: Welcoming and Inspiring a new generation of bunker traders to KPI OceanConnect

As one of the most trusted partners in the marine energy sector, we’re proud to have officially launched our first “get fuelled” training programme this...

KPI OceanConnect welcomes Greek maritime executives to alternative fuels & carbon markets forum

Athens, Greece – 3 October 2023: KPI OceanConnect, a leading global marine energy solutions provider, held its Alternative Fuels & EU ETS Forum for clients in Greece...

KPI OceanConnect appoints Melvin Lum as Commercial Director for the Global Accounts team in Singapore

KPI OceanConnect, a leading global marine energy solutions provider, today announced the appointment of Melvin Lum as Commercial Director for its Global Accounts team in...